On 03 March 2018, the Pakistan Air Force (PAF) formally equipped the No. 88 Search-and-Rescue (SAR) squadron with two Leonardo AW139 utility helicopters. The No. 88 “Combat Support Squadron and Advanced Helicopter Training School” operates from Shahbaz Air Base in Jacobabad, Sindh in Southern Air Command. It is also equipped with a Russian Helicopters Mil Mi-171.

Lauding the induction, the PAF Chief of Air Staff (CAS) Air Chief Marshal (ACM) Sohail Aman stated: “[The] PAF, after an in-depth analysis of [available] search-and-rescue platforms … selected [the] AW139 as the most effective solution for [the PAF’s] requirements”.[1] It appears that trials for the AW139 had taken place in 2015 and 2016, with the selection being made before the summer. In May 2016, British aviation journalist Alan Warnes reported that the PAF selected the AW139 in favour of the Lockheed Martin S-70 Black Hawk.[2] In February 2017, Leonardo stated that Pakistan selected the AW139 as its “preferred new generation helicopter for [the] replacement of older types currently in service”.[3]

The AW139 is a twin-engine helicopter with a seating capacity of 12. It has a ferry range of 1,250 km and service ceiling of 20,000 ft, endurance of five hours, maximum cruise speed of over 300 km/h and payload capacity – via external cargo-hook/sling – of 2,200 kg. With a maximum take-off weight (MTOW) of 6,000 to 7,000 kg (i.e. six to seven tons), it is a light-to-medium-class utility helicopter platform.

Pakistan ordered three batches of AW139s from Leonardo – i.e. in August 2016, February 2017 and in May 2017. Industry sources have told Quwa that including the four AW139s delivered (i.e. two to the PAF and two to the Pakistan Army), Pakistan currently has a total of 14 AW139s on order. According to the 2015-2016 Ministry of Defence Production (MoDP) yearbook, each AW139 cost $19.75 million U.S.[4] The ones already delivered to Pakistan were from the August 2016 batch, thus suggesting that follow-on deliveries should be taking place in mid-to-late 2018, with commissioning in late 2018 or early 2019.

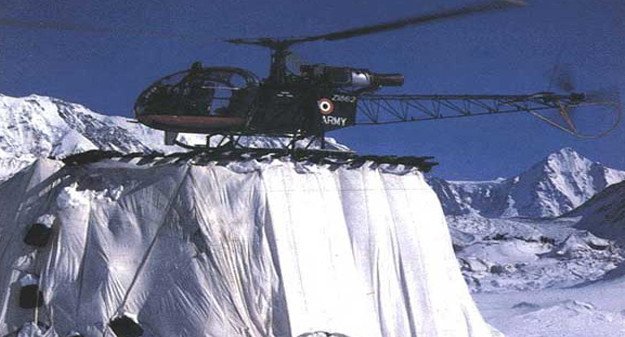

Seeing that two of the four initial batch AW139s (ordered in August 2016) were delivered to the Pakistan Army, the remaining 12 could be for the PAF. This would make sense as it would correspond to the PAF’s apparent plans to supplant its aging Alouette III helicopters, which are in service with seven squadrons as well as the Helicopter Flight School (HFS). If each of these squadrons (i.e. No. 81, No. 82, No.83, No. 84, No. 85, No. 86 and No. 87) operates two ‘light’ SAR helicopters, it would amount to 14 more helicopters.[5]

Granted, the PAF currently has 10 AW139s left for delivery (i.e. four short of exactly replacing the Alouette IIIs on a one-to-one basis), but there is nothing to preclude the PAF from issuing another batch order. Alternatively, superior performance (in terms of range, payload and endurance) could also necessitate fewer AW139s compared to Alouette IIIs to maintain a comparable or even superior supporting rotary capability. The No. 88 Squadron will also serve as a training unit – i.e. ‘Advanced Helicopter Training School’ – for this as well as potentially other helicopters in the PAF (e.g. the Mi-171). It also appears that the PAF’s composite helicopter units will operate as mixed AW139 and Mi-171 units.

The No. 88 is not alone in being a composite/mixed-fleet unit, the No. 84 and No. 87 each operate the Mi-171 along with their respective Alouette IIIs. The 2015-2016 MoDP yearbook outlines plans for a total of four Mi-171-equipped SAR squadrons.[6] The rationale for composite fleets could have to do with the role these specific SAR squadrons will be expected to play, i.e. Combat Search and Rescue (CSAR). CSAR would suggest that there will be an element of insertion in enemy territory – or at least an expectation that the recovery operation will see confrontation with enemy forces – hence the need for a platform that benefits from a proven record operating in such environments. The PAF’s Special Service Wing (SSW) has been shown – albeit in promotional material – of using the Mi-171.

It is unclear how well-equipped the AW139s are for CSAR. Photos (see below) show that the AW139s are equipped with FLIR Systems’ Star SAFIRE electro-optical and infrared (EO/IR) turrets. However, CSAR will necessitate the inclusion of countermeasures – such as chaff/flare dispensers – and potentially electronic warfare (EW)-based jammers (for some defensibility against fast-jet and radar-based air defence threats).

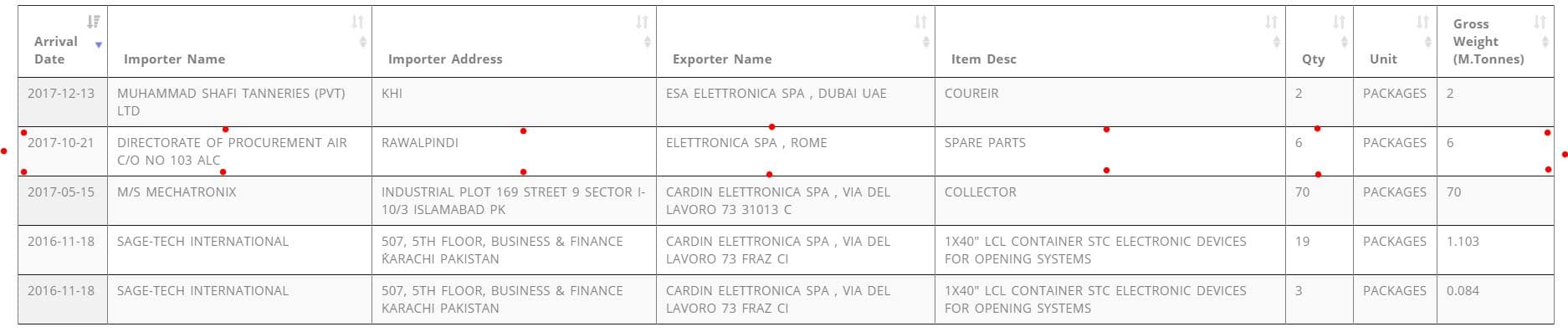

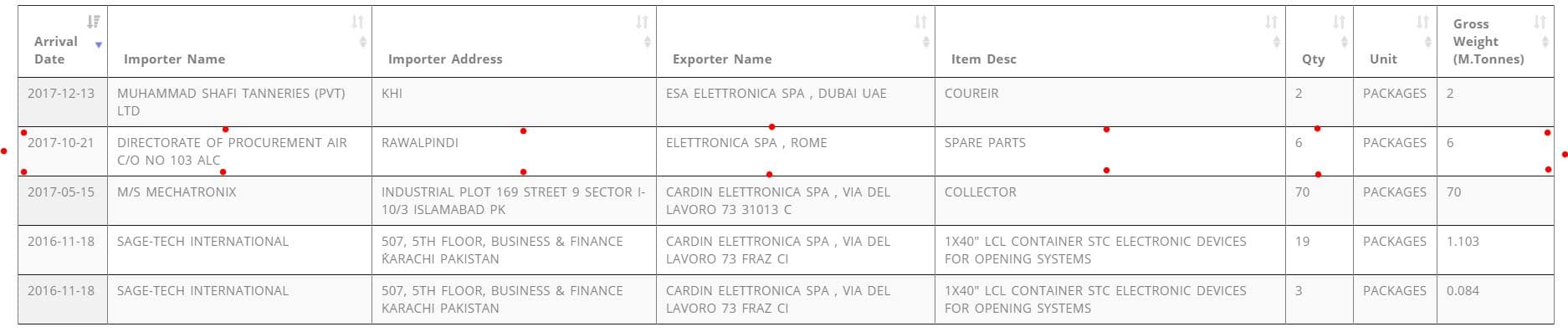

Although there is no confirmation at this time of the PAF’s AW139s being equipped to that extent, it must be noted that the PAF has imported some equipment from the Italian electronics company Elettronica. Its primary delivery to the PAF’s Directorate of Procurement had occurred in October 2017 for “spare parts”, an interesting delivery considering that Elettronica’s airborne catalogue largely comprises of electronic support measures (ESM), electronic countermeasures (ECM) and electronic warfare (EW) equipment. It is not known what the PAF procured from Elettronica, but the AW139 could potentially be a factor (albeit, the JF-17, Mirage ROSE, Erieye and C-130 are also plausible outcomes for Elettronica subsystems).

The Pakistan Navy is already a customer of Elettronica by procuring its ESM (e.g. passive sensors) for its ATR-72 maritime patrol aircraft (MPA) program.[7] Thus, the notion that the PAF could equip the AW139 with EW/ECM/ESM for CSAR is plausible, a suitable vendor is available – and approved by its government (Italy) – to undertake such a program. In fact, even the prospect of a relatively high unit-cost need not be a concern for the PAF – with a total of 12-14 helicopters involved, the total cost is manageable.

It appears that the AW139’s primary competitor was the S-70 Black Hawk, though one might also view the Mi-171 and Airbus Helicopters H215 Super Puma as viable candidates. Each helicopter benefits from scale, operational maturity and widespread commercial, government and military adoption. Thus, each one will have likely been among the affordable options in the medium-weight class, in contrast to more sophisticated platforms such as the NH-90, H225 Cougar and the MH60-variants of the Black Hawk.

It is unclear if there was significant variance in the respective procurement costs of these helicopters, but in the case of the S-70, the fact that it involves the US as a supplier might have been an obstacle. Interestingly, Alan Warnes’ report regarding the AW139 being selected over the S-70 followed the US Congress’ decision to withhold Foreign Military Financing (FMF) for the PAF’s request for eight new-built F-16C/D Block-52. In both cases – i.e. the F-16 and S-70 – is that the principal original equipment manufacturer (OEM) was Lockheed Martin (which bought Sikorsky, the initial OEM of the S-70).

For the PAF, additional factors may have included long-term operating or lifecycle costs. Unlike the S-70, the PAF has a measure of support already in place for the AW139, namely experience in supporting its Pratt & Whitney Canada PT6 engine platform (via the Bell 412EP, Grand Caravan EX, King Air 350ER, etc). Pakistan Aeronautical Complex (PAC) was also slated to establish a maintenance, repair and overhaul (MRO) centre for the PT6. That said, a variant of the S-70’s GE T700 turboshaft engine was also being inducted through the Bell Helicopter AH-1Z Viper, though other factors – e.g. the precariousness of currently procuring from the US – likely dampened any aspirations for growth in that area.

The alternative could have involved procuring the Black Hawk through Turkey. However, given that it is several years from materializing – i.e. giving the PAF an opportunity to properly examine it and conduct negotiations – it was unlikely to have been a factor. As for the Mi-171 and H215M, key factors could be a mix of potentially higher operating costs (vs. the notably strong commercial adoption of the AW139, which means its support is not necessarily tied to defence contractors, but competitive civil aviation services firms too) and Italy’s relative willingness to trade with Pakistan, which could reflect in more favourable financing terms. The PAF slotted the Alouette III for replacement in the near-term. However, for the long-term, the question is whether the Pakistan Army Aviation Corps (PAA) and Pakistan Naval Aviation (PNA) will also adopt the AW139, thus enabling for standardization in SAR and light-to-medium-weight utility helicopters between the three service arms (and, interestingly, the Pakistani government and private sector as well, which would be unprecedented in Pakistan).

Though a legacy platform, the Alouette III has the distinction of being a standard helicopter type between the PAF, PAA and PNA in their respective lightweight utility and SAR requirements. The PAA has six units flying the Alouette III, though it is unclear how many helicopters this credibly represents.[8] However, it may be comparable to the PAF fleet. The PN only has one unit operating the Alouette III, but the expansion of offshore patrol vessels (OPV) equipped with the ability to support helicopter operations in the PN and Pakistan Maritime Security Agency (PMSA) may also open additional utility helicopter procurement. Thus, it would follow that the PAF AW139 selection is a precursor to an expanded procurement roadmap.[9]

However, the PNA also operates the Harbin Z-9-platform from China, a comparable helicopter (at least in terms of size and specifications), giving it an alternative long-term option for replacing its Alouette IIIs and increasing its fleet. On the other hand, by taking two of the initial four AW139s, the PAA is can supplant its Alouette IIIs with the AW139. Standardization – especially across the armed forces, government and private sector – could rationalize the entry of deeper domestic sustainment for the AW139.

Embracing an off-the-shelf platform is unideal. As discussed in an earlier Quwa Premium piece (about the benefits of high-risk and high-reward partnerships over offsets and transfer-of-technology purchases),[10] the set of benefits available to the Pakistani industry are limited. First, transfer-of-technology (ToT) has a cost if procured by the state for its public sector, and in turn, a reliance may be formed with the OEM – i.e. Leonardo – for long-term support in terms of restricted components and upgrades.

Furthermore, ToT of a present system seldom guarantees domestic advancement – i.e. to advance, Pakistan must commit to a new system with ToT. One will notice how Pakistan Ordnance Factories (POF) and Heavy Industries Taxila (HIT) have not internally progressed beyond the Cold War-era G-3 battle rifle and M113 armoured personnel carrier (APC), respectively. Essentially, industry advancement tied to another off-the-shelf purchase, and that depends on requirements and availability of public funds.

Thus, a ToT deal cannot compensate for a dearth of domestic research and development (R&D), the latter is only possible through pure domestic efforts or cost-sharing/risk-sharing R&D partnerships or joint-ventures. However, ToT can serve as a method of reducing costs through the long-term by enabling domestic industry actors to undertake sustainment – such as spare parts manufacturing, overhauling, MRO, etc – using Pakistani production costs, especially its cheaper currency (vis-à-vis the USD or Euro).

As for offsets, while the OEM might absorb the initial cost of raising domestic production facilities (such as a final assembly line or subassemblies manufacturing line), that foreign-owned entity’s profits will likely depart Pakistan as a hard-currency outflow, thus straining Pakistan’s foreign-exchange reserves. However, it should be noted that Leonardo is not averse to committing to offsets in key markets, it co-established a helicopter assembly plant in Algeria in 2016. Growth in Pakistan through AW139 purchases from a wide set of customers could spur that interest provided Pakistan can offset the long-term cost of investment with additional foreign direct investment (FDI) or stronger exports from Pakistani businesses.